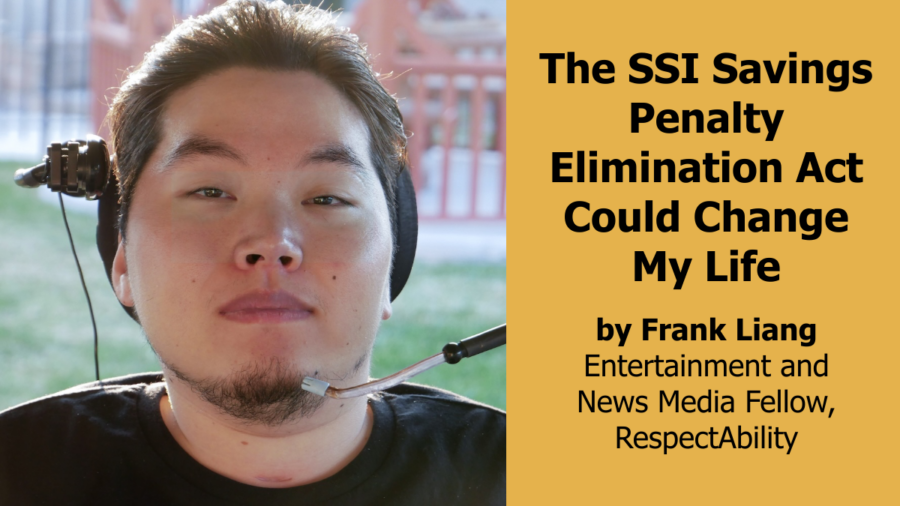

Millions of low-income people with disabilities and older adults receive Supplemental Security Income (SSI) each month. For these recipients, SSI is a vital source of income that pays for rent, food, transportation, and other living expenses. However, people who receive SSI are trapped in a cycle of enforced poverty. To receive SSI, an individual may have no more than $2,000 in savings at any given time. If a person works part-time or sporadically, their income plus SSI benefits may easily put them over the $2,000 asset limit. This disincentivizes working and saving money. If two people who both receive SSI get married, they are not each allowed to have $2,000 in assets; they are only allowed to have $3,000 between them. This is known as the “marriage penalty,” because it prevents many couples who receive SSI from getting married. The extremely low asset limits prevent low-income people with disabilities and older adults from working, saving, and getting married.

The bipartisan SSI Savings Penalty Elimination Act would increase the SSI asset limits from $2,000 to $10,000 for unmarried individuals and eliminates the marriage penalty by allowing two SSI recipients to get married and have up to $20,000 in assets as a couple. The bill also requires asset limits to be adjusted yearly to keep up with the cost of living.

How can you help?

In our efforts to ensure that this bill passes through Congress, please contact your Senators and your Member of the House of Representatives to encourage them to sponsor the SSI Savings Penalty Elimination Act. Every call and every voice make a difference!

Assets are defined as the resources you own, including cash, money in checking or savings, cash surrender value, stocks and bonds, cars, and real estate. Under Supplemental Security Income (SSI), individuals cannot exceed an asset cap of $2,000, while married couples have a cap of $3,000.

Assets are defined as the resources you own, including cash, money in checking or savings, cash surrender value, stocks and bonds, cars, and real estate. Under Supplemental Security Income (SSI), individuals cannot exceed an asset cap of $2,000, while married couples have a cap of $3,000.

With legislatures around the country in full swing, you may be headed to your state capitol or statehouse soon. Effectively communicating with a state legislator to advocate for a piece of legislation involves careful planning, clear communication, and maintaining a professional demeanor. Here’s a step-by-step guide to help you navigate this process, from reaching out initially to following up.

With legislatures around the country in full swing, you may be headed to your state capitol or statehouse soon. Effectively communicating with a state legislator to advocate for a piece of legislation involves careful planning, clear communication, and maintaining a professional demeanor. Here’s a step-by-step guide to help you navigate this process, from reaching out initially to following up.

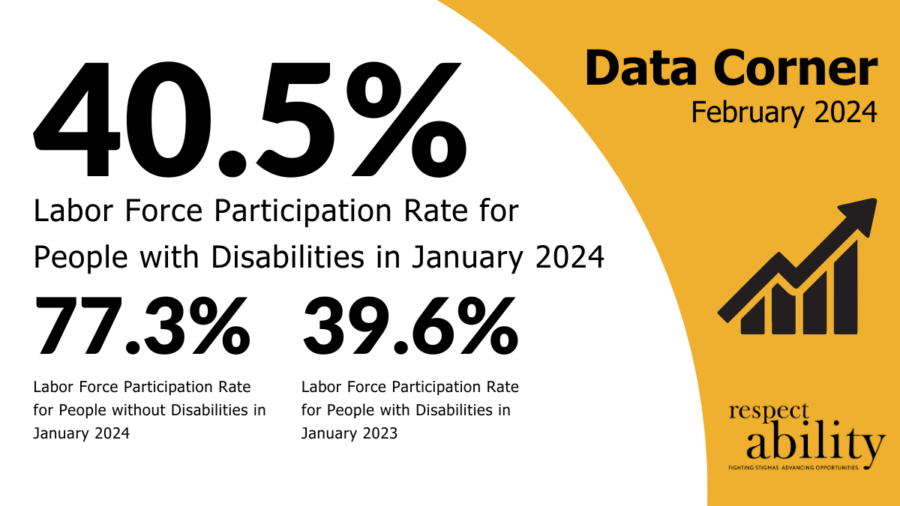

According to the latest

According to the latest